Changing Patterns XXIII Innovation Forum generates in-depth discussion

March 07, 2017

On Tuesday, March 7th, MCBC and The Mel King Institute brought together a diverse group of stakeholders for an Innovation Forum to discuss our report, Changing Patterns XXIII. In it’s 23rd year, Changing Patterns XXIII offers information on patterns of mortgage lending in the City of Boston, Greater Boston, and Massachusetts. Participants heard from the report author, Jim Campen, on some of the key data findings from the report. They then heard from an expert panel, moderated by Elliot Schmiedl, Director of Homeownership for MHP, including Jeremiah Battle, Staff Attorney, National Consumer Law Center; Renee Owens, Community Mortgage Loan Officer, Blue Hills Bank; and Karen Wiener, Chief Operating Officer, Citizens’ Housing and Planning Association. Participants then used the report and remarks of the panelists to explore why these patterns have emerged and to dig into the data and issues behind them to have an in-depth conversation on issues of racial and income disparities, homeownership barriers, and the potential solutions to emerging patterns of concern.

The report covers:

- The Level and Composition of Mortgage Lending

- Borrower Race/Ethnicity and Income

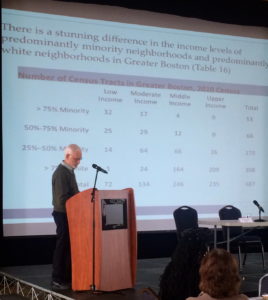

- Neighborhood Race/Ethnicity and Income

- Denials of Mortgage Applications

- Lender Activity

- Legislative and Regulatory Developments

The report and supplemental materials, including an infographic can be viewed at https://financialequity.net/publications/changing-patterns-xxiii/